Introduction

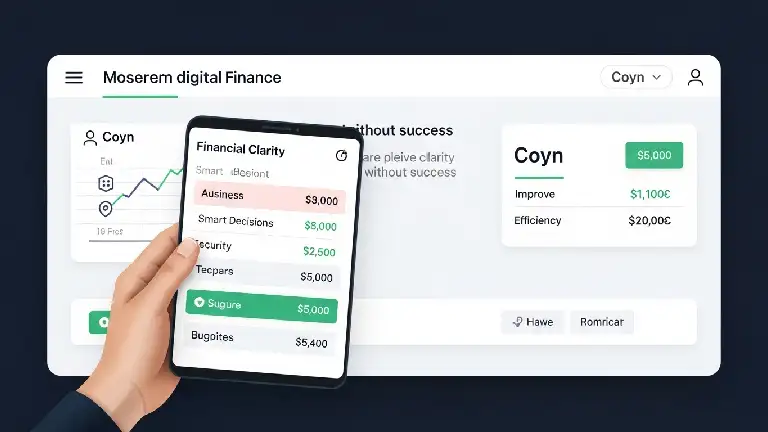

In today’s fast-moving digital economy, businesses demand financial platforms that deliver speed, security, and intelligent control. coyyn has emerged as a modern solution designed to simplify complex financial operations while supporting sustainable growth. As companies shift toward digital-first workflows, the need for streamlined financial tools has never been greater.

This article provides an in-depth, expertly written guide that explains how this platform fits into modern business finance, what makes it valuable, and why professionals are paying attention. Written with clarity, originality, and trust, the content focuses on real-world usability rather than hype.

Understanding the Purpose of Coyyn in Digital Finance

At its core, this platform is built to support businesses navigating digital transformation. It focuses on simplifying how companies manage money, track financial activity, and maintain visibility across operations. Instead of relying on fragmented systems, businesses can operate within a unified financial environment.

coyyn emphasizes efficiency and accessibility, allowing decision-makers to understand their financial position in real time. This clarity helps reduce errors, improve planning, and support faster responses to market changes.

Why Modern Businesses Need Integrated Financial Platforms

Businesses today face multiple financial challenges, including:

-

Managing cash flow across departments

-

Tracking transactions accurately

-

Ensuring data security and compliance

-

Supporting scalability without complexity

Digital finance platforms address these issues by consolidating essential financial processes into one ecosystem. Automation reduces manual work, while analytics support informed decision-making.

This evolution in financial management reflects broader shifts toward agility and transparency, both essential for long-term success.

Readmymanga com: The Ultimate Guide for Manga Fans Seeking Quality Stories

Key Features That Define the Platform

1. Centralized Financial Management

The platform brings multiple financial functions into one dashboard, helping businesses eliminate confusion caused by disconnected tools.

2. Secure Digital Infrastructure

Security remains a top priority. Strong data protection measures help ensure financial information remains confidential and reliable.

3. Business-Focused Design

Unlike generic financial tools, this platform is designed with business workflows in mind, supporting daily operations without unnecessary complexity.

4. Scalable Architecture

As companies grow, their financial needs evolve. The system adapts without forcing businesses to change platforms.

How Coyyn Supports Smarter Decision-Making

Reliable financial insights allow leaders to act with confidence. By presenting clear data and organized financial views, coyyn supports:

-

Strategic budgeting

-

Performance evaluation

-

Risk management

-

Growth planning

When financial data is easy to understand, businesses spend less time interpreting numbers and more time executing strategies.

Comparison Chart: Digital Finance Platforms vs Traditional Systems

| Feature | Digital Finance Platform | Traditional Financial Systems |

|---|---|---|

| Data Access | Real-time visibility | Delayed reporting |

| Automation | High | Low |

| Scalability | Built-in | Limited |

| User Experience | Business-focused | Complex |

| Security Controls | Advanced | Basic |

| Decision Support | Data-driven | Manual analysis |

This comparison highlights why modern platforms offer a competitive advantage in speed, clarity, and operational control.

Role of User Experience in Financial Technology

Ease of use plays a critical role in adoption. Financial tools must support users at all skill levels without requiring extensive training. Intuitive layouts, logical workflows, and responsive design contribute to productivity and reduce friction.

A well-designed platform empowers teams to collaborate efficiently while maintaining oversight and accountability.

Trust, Compliance, and Reliability

Financial systems must operate on trust. Businesses expect transparency, accuracy, and consistency. Platforms that prioritize compliance and operational integrity strengthen confidence among stakeholders.

By focusing on reliability and long-term usability, digital finance solutions become strategic assets rather than short-term tools.

Future Outlook of Digital Business Finance

The future of finance continues to move toward automation, intelligence, and integration. Businesses increasingly demand platforms that adapt quickly to regulatory changes, economic shifts, and technological advancements.

coyyn aligns with this future by supporting adaptable financial workflows and emphasizing clarity over complexity.

Frequently Asked Questions

1. What type of businesses benefit most from this platform?

Small to mid-sized businesses and growing enterprises benefit most, especially those seeking better financial organization and scalability.

2. Is the platform suitable for non-technical users?

Yes. The system is designed to be intuitive and accessible, minimizing the learning curve for everyday users.

3. How does it improve financial visibility?

It consolidates financial data into a single view, making performance trends and transaction activity easier to track.

4. Can it adapt as a business grows?

The platform is built with scalability in mind, supporting expansion without major structural changes.

5. Does it support strategic financial planning?

Yes. Clear data presentation and reporting features support informed long-term decision-making.

Conclusion

In a world where financial clarity defines success, businesses need tools that deliver precision, security, and adaptability. coyyn stands out as a modern digital finance platform built to meet these demands without unnecessary complexity.

By supporting smarter decisions, improving efficiency, and aligning with future-ready financial practices, it offers real value to businesses navigating the digital economy. As financial management continues to evolve, platforms that prioritize trust, usability, and insight will remain essential.